Table of Contents

The possession interests of capitalists are represented by 'devices', which are provided and retrieved in a fashion comparable to a device count on. The CCF is an unincorporated body, not a separate legal entity and is transparent for Irish legal and tax obligation objectives. Consequently, capitalists in a CCF are dealt with as if they straight have a proportional share of the underlying investments of the CCF rather than shares or devices in an entity which itself has the underlying financial investments.

Tax obligation openness is the primary attribute, which distinguishes the CCF from other types of Irish funds. The CCF is authorised and managed by the Reserve bank. Please note that this site is not planned to respond to questions regarding specific financial investments nor is it meant to provide specialist or legal recommendations.

Our team believe all systems ought to hand down ballot legal rights for the business you spend in, so you can have your state as a shareholder. Numerous systems do this if you 'choose in', however others don't, which leaves investors in the dark or perhaps incapable to vote. The AIC's 'My share, my ballot' project is battling to change this.

The act likewise supplies for the law of mutual fund administrators by CIMA. Not all shared funds are regulated.

Investment Management Companies in Baytown

The categories of funds controlled under the MFL are laid out below. The MFL (Section 4( 1 )) defines that a mutual fund operating in and from the Cayman Islands need to have a permit unless: a certified mutual fund administrator is offering its primary workplace; it meets the criteria laid out in Section 4( 3 ), which enables for funds to be registered, or it is exempt from guideline under Area 4( 4 ).

The four automobiles generally used for operating shared funds are the spared firm, the segregated profile company, the device count on and the exempted restricted collaboration. The excused firm might redeem or purchase its own shares and might therefore operate as an open-ended company fund. Closed-ended business funds can likewise be established utilizing the excused business and it is a fairly uncomplicated procedure to convert from one to the various other.

The SPC makes it feasible to offer a means for different groups to secure their assets when continuing business through a solitary legal entity. The device trust is generally developed under a trust action with the financiers' passion held as count on devices. The excused and limited collaboration provides a second unincorporated vehicle and it can be created as easily as the exempted company or the system depend on.

Have you experienced a major event in your life that has transformed your economic situation?!? Possibly you're looking for a person to assist develop a roadway map for your monetary future. These and various other situations could make you consider calling an investment specialist.

Investment Management Companies

Below are the most typical types of financial investment experts and key functions. Legal representatives provide lawful assistance to clients related to financial preparation and financial investment choices and may stand for customers in conflicts with firms or investment specialists. An excellent area to start when buying for a financial investment specialist is to ask household, close friends and associates that already spend for the names of individuals they have actually made use of.

The following actions will help you make an audio option:, including inspecting to see if a person has a criminal document. Do this you sign any type of files, make any investments or pass on any type of money. A vital action in choosing a financial investment expert is to see if the specific and their company are registered.

Has valuable info and tips on how to pick a financial investment specialist. That are you registered with and in what capability? Do you hold any other specialist credentials?

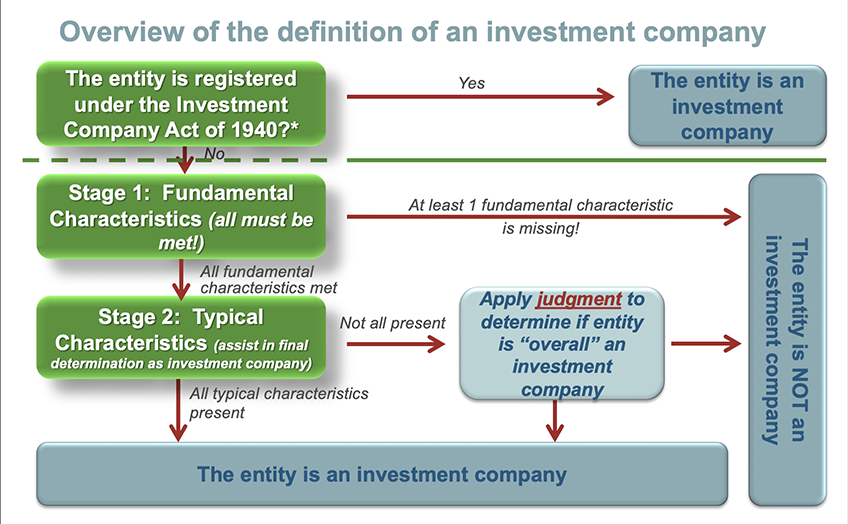

Investment Company

Level with your expert concerning your investing experience and the amount of threat you're prepared to take. Steer clear of any investment professional who pushes you to spend rapidly or refuses to provide details for you to take into consideration carefully.

An American depositary invoice (ADR) is a certificate representing shares of a foreign security. It is a form of indirect possession of foreign securities that are not traded directly on a nationwide exchange in the USA. Banks purchase the underlying safeties on foreign exchanges via their foreign branches, and these foreign branches remain the custodians of the safeties.

Numerous ADRs are registered with the U.S. Securities and Exchange Compensation and traded on national exchanges; however, some ADRs are not signed up and traded on nationwide exchanges. Capitalists purchase these non-registered ADRs directly from their providers or via other private professions (i.e., "over-the-counter"). An "American depositary share" represents a solitary share of the underlying safety.

Navigation

Latest Posts

Investment Management Companies servicing Baytown, Texas

Investment Firms local to Baytown

Landscape Design Contractor servicing Baytown, Texas